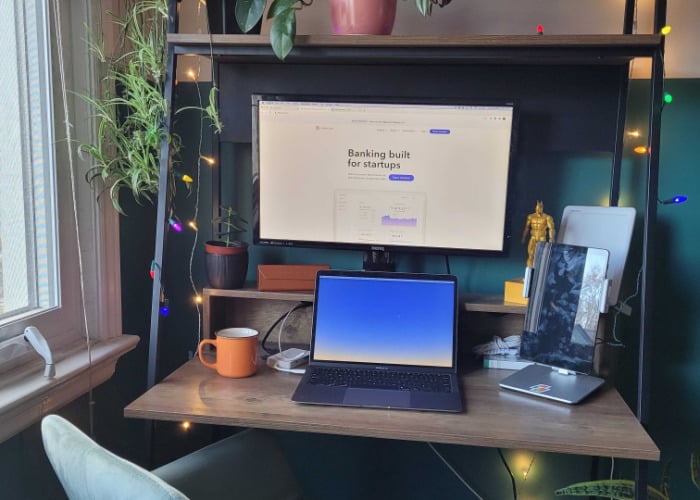

Local banking solutions step up following Mercury’s withdrawal

Techpoint Africa | Chimgozirim Nwokoma - Aug 01, 2024

Featured entitiesThe most prominent entities mentioned in the article. Tap each entity to learn more.

AI-generated highlightsThe most relavant information from the article.

- Several African startup founders have been asked to close their accounts with American neobank, Mercury, due to compliance changes.

- African startups often need US bank accounts to boost credibility with investors.

- This situation has highlighted the opportunity for local startups to provide financial solutions for African entrepreneurs.

CommentaryExperimental. Chat GPT's thoughts on the subject.

The sudden closure of accounts by Mercury has negatively impacted African startup founders who rely on US bank accounts for credibility. This highlights the need for tailored compliance procedures and financial solutions that cater to the unique needs of African startups. Local startups have the opportunity to fill the gap left by Mercury, but they face challenges in gaining mainstream acceptance and overcoming perception issues.

SummaryA summary of the article.

Also readRecommended reading related to this content.

Newsletter

Sign up for the Newsletter

Discussion

Need startup advice?

Leverage the Hadu community to get answers and advice for your most pressing questions about Africa Tech.